10 tips for retiring in 2023

Are you getting close to retirement?

That’s a question only you can answer. There’s no longer any official ‘retirement age’, so in most jobs it’s you who chooses when to ride off into the sunset.

Well, how about now?

Could you decide that this is your last year in the rat race? What would it mean to start drawing your pension in 2023? Now, that’s a question we can help you with. Here are ten key things for you to think about.

DO remember: retirement is long-term

Is now a good time to retire?

That’s the wrong way to look at it. Consider: you hope to be retired for two decades or more. Suppose you had retired back in the year 2000; by now, you’d have lived through the financial crisis, Brexit, Covid, recessions, and lots else (and you could still be only in your eighties).

A huge amount will happen over the course of your retirement – some of it completely unforeseeable. So take nothing for granted. Plan for contingencies.

DON’T forget inflation

Inflation is one such contingency. While you’re employed, it’s easier to ignore, as pay-rises tend to absorb it. In retirement, your only paymaster is you. A retiree in 2000 would have paid only £100 for goods that today would cost over £170 – and that’s with fairly low inflation. In short: you’ll need more money than you might expect.

DO get a pension forecast

You can request a forecast of your State Pension here. But it’s also crucial to do a forecast of all your pensions, including workplace schemes and any private pensions – along with other savings and potential sources of future income. Much has happened in the past 12-24 months, so your position might have changed significantly since you last looked.

Contact your pension providers, past and present, and ask for current statements. This includes tracking down any previous workplace pensions.

How many jobs did you have in your early career? How many might have offered pensions, when you weren’t paying much attention? Contact the government’s Pension Tracing Service and start rounding up those hidden retirement savings.

Finally, talk to your adviser about how your pension is invested. An investment review can help you choose funds more suited to your plans, and to your preferred level of risk.

DON’T fall for pension scams

You’re approaching so-called ‘retirement age’ and the internet knows it. You’ll see it in your targeted online ads. And you will be on many people’s lists. Expect strangers to contact you, offering ‘free pension reviews’ or ‘retirement investments’ with impressive rates of return. Look out for adverts offering similar. Then dismiss them all. The only advice you should heed is from a financial adviser whom you have chosen and hired yourself.

DO seek independent advice on your pension options

You have considerable choice about how you draw your workplace and private pensions. Choice is good, but it can be confusing. Bear in mind, too, that any decision you make now will affect your whole retirement – including doing nothing!

Everyone near retirement should read up on the pension options available. First, make sure you know the difference between a final salary (aka defined benefit) pension, and a money purchase (aka defined contribution) pension.

Final salary pensions are workplace schemes that pay you a guaranteed income for life – as such, they’re great things to have. Some people choose to transfer them to money purchase schemes, but this is an area that requires professional advice.

Most pensions are money purchase schemes. A money purchase pension is simply a pot of investments you have built up over time. From the age of 55, you can access this pot to provide yourself with an income.

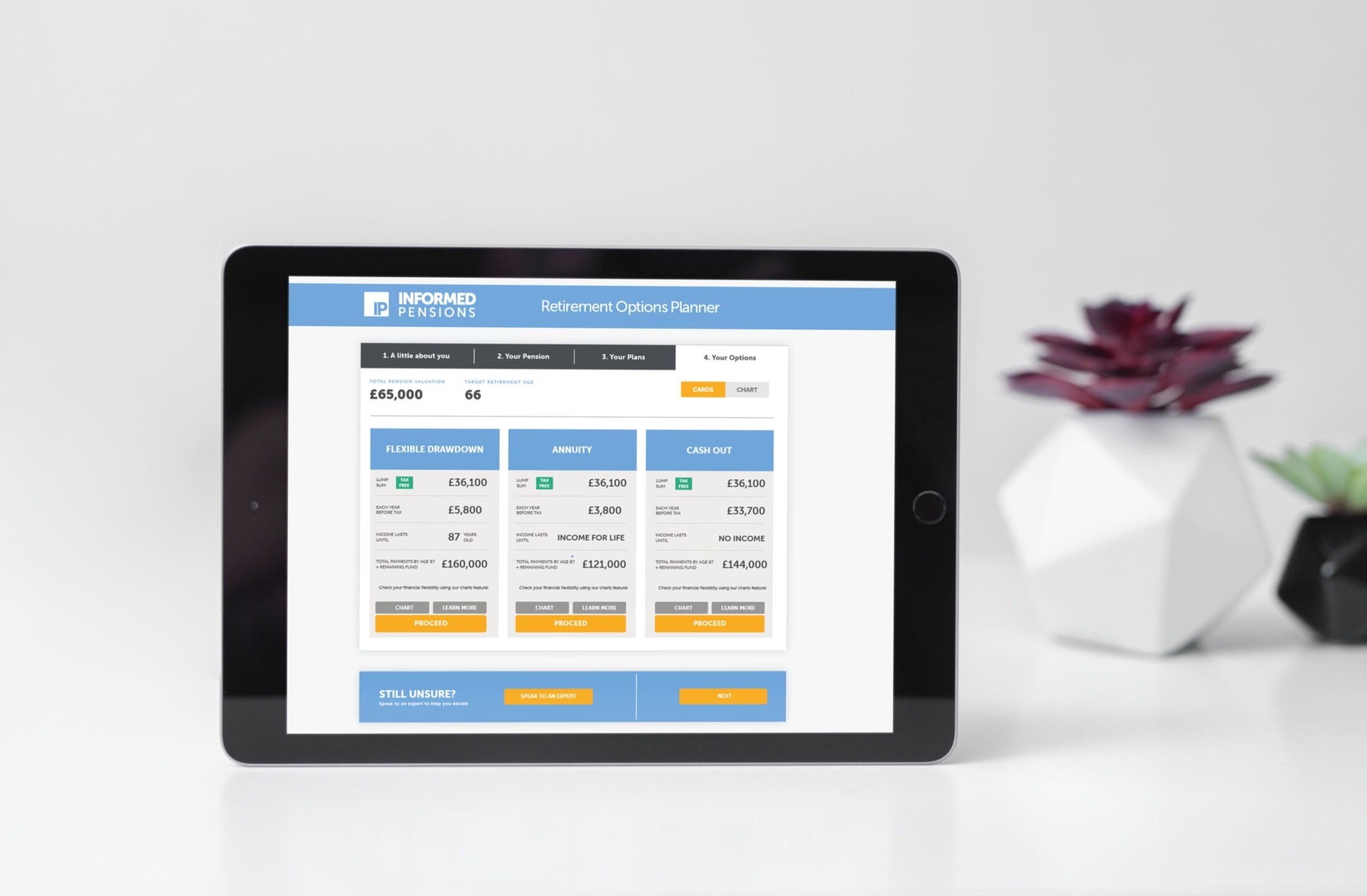

Income taken from pensions is taxable, but you’re entitled to take 25% of your pension pot tax free (usually as a lump sum up front). Your main options for taking the rest are:

· An annuity

You use your pot to buy an insurance product that pays you a guaranteed income for life

· Drawdown

Your pot is reinvested in the stock market and you make flexible withdrawals

You don’t have to choose either option – you can just make a lump sum withdrawal from your existing pension pot. But it’s highly unlikely to be the best way for you.

Note that you can mix-and-match the two main options; for instance, buy an annuity with half your pot, and put the other half into a drawdown product. But you must ensure that whatever you choose is suited to your long-term needs. So be proactive: book a meeting with an adviser, and pick one who specialises in people at your wealth level.

DON’T simply take the first pension product your provider offers

Your pension statement from each provider will tell you the current total value of your pot. It may also include an estimate of the annual income that this pot could generate. Something like, ‘This could provide you with an income of £15,000 per year.’

This estimate usually assumes you will take one of this provider’s annuity products. But remember: you don’t have to do this. You are free to shop around. It’s very likely you’ll find better value elsewhere, and you may also decide that a different type of product is better suited to your needs. Independent advice is crucial here, too.

DO be risk-aware

There are many potential risks lurking in the area of pensions, particularly now that the options are so flexible.

One common pitfall is tax. The ability to take large lump sums from a pension pot encourages many retirees to do just that. But of course, pension counts as income. So, if a person decides to take £50,000 from their pension in a single year (with their State Pension bringing their annual income to nearly £60,000), they are pushed well into the higher rate tax band. Result: a hefty tax bill. That’s why you should plan your withdrawals carefully, and keep an eye on those tax bands.

Another danger of drawdown is known as ‘sequencing risk’. In plain English, this means ‘taking out money at a bad time’. In this case, a ‘bad time’ is when the stock market is falling (or just failing to grow). Why is this a risk? Because the smaller your fund is, the slower it will grow – so taking out money in a falling market makes it harder to recover the lost value later. It can therefore be helpful to have another source of income (e.g. an annuity) to fall back on during periods of stock market decline.

The most obvious risk of drawdown is simply taking too much income and running out of money. There is no such risk with an annuity – but the risk there is not having enough income or flexibility. Also, you can’t pass an annuity to your beneficiaries (except your spouse), as you can with drawdown. As you see, weighing up all these risks isn’t easy.

DON’T just do what your friend did

Your retirement is yours – no-one else’s. Your life will unfold in its own way. Your priorities will be different. You may have family in different situations. And your financial position won’t be identical. You need to make pension choices based on your circumstances, and your needs. In retirement, an off-the-peg solution may be adequate at best, and can often prove a costly mistake. By contrast, the cost of bespoke advice is insignificant compared to how much it can save you.

DO maximise your pension tax relief

How many investments do you know where you can get an instant gain of 25% on everything you pay in? How many give you an instant gain of 66%? Believe it or not, that’s the effect of pension tax relief. Every pound you pay in becomes £1.25, because the 20% basic rate tax you would have paid is returned to you. And if you’re a higher-rate taxpayer claiming tax relief, that pound can become around £1.60, because you’re recovering 40% tax.

So take full advantage of this as you near retirement. Increase your pension contributions in the final months (or years). If you have enough savings, consider transferring some into your pension, to get that free-money boost.

DO relax into retirement

The whole point of stopping work is to enter a new life of freedom: to be free from the daily grind, free to set your own pace, and free (mostly) from stress. Which means the last thing you want to be doing is worrying about whether you’ve made the right pension choices. The simplest way to avoid such worry is to take independent advice. If you were buying a home, you’d hire a solicitor rather than risk tackling the conveyancing process yourself. The same applies with pensions and financial advice. It’s a similar amount of money at stake: so seek help from a professional, and be free to relax.

Nick Green is a financial journalist and blogger who has written for a range of personal finance publications and websites, including Unbiased.co.uk and Nested.com, and accounting firm BDO. He specialises in making products such as pensions, mortgages, investments and insurance more accessible to the general public.